Introduction

Barbados is no longer just a tropical paradise for vacationers. With its growing tourism industry, stable economy, and favorable real estate laws, the island has become a magnet for property investors from around the world.

Whether you’re a Caribbean local or an international buyer, choosing the right real estate investment in Barbados can offer substantial returns.

In this guide, Tropical Finance Broker shares expert insights to help you choose high-return real estate properties and outlines how our team can assist you from financing to closing the deal.

Why Invest in Real Estate in Barbados?

Barbados offers a compelling mix of factors that make it an ideal location for real estate investment:

- Stable Government and Legal System: As a Commonwealth country, Barbados has a well-established legal and property rights system that protects investors. The Central Bank page is great for endless information on this topic.

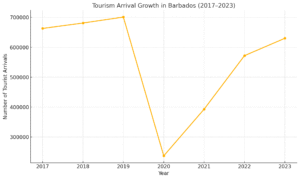

- Tourism Growth: The island attracts over 500,000 visitors annually, ensuring a high demand for vacation rentals. Here is a line chart showing the tourism arrival growth in Barbados from 2017 to 2023. It reflects strong growth before the 2020 pandemic dip and a steady recovery afterward—key data that supports the case for high-return real estate investments on the island. You can visit this page – Visit Barbados – for further information on what the island really offers!

- Attractive Rental Yields: Some areas report rental yields as high as 8-10% annually.

- Tax Incentives for Foreigners: Foreign investors enjoy several benefits, such as no restrictions on property ownership and access to international banks. Check out this article from the US Embassy that gives additional information.

- High Demand for Long-Term Rentals: Professionals, remote workers, and expats provide a solid year-round rental base. This website can provide additional information – CaribJournal

Investing in Barbados isn’t just about owning property in paradise—it’s about building wealth with a strategic asset.

Understanding High-Return Property Investments

A high-return property investment is one that provides strong cash flow, capital appreciation, or ideally, both. When evaluating these properties in Barbados you need to consider:

- Rental Yield: The percentage of rental income compared to the property price.

- Occupancy Rate: How frequently the property is rented out.

- Maintenance Costs: Properties that require minimal upkeep tend to be more profitable.

- Future Development Plans: Areas with upcoming infrastructure or hotel projects can signal strong appreciation potential.

Barbados offers the perfect balance: properties in scenic locations with access to beaches, entertainment, and airports that generate strong returns year-round.

Top Locations in Barbados for High ROI Properties

Here are some of the best-performing areas:

- West Coast (Platinum Coast):

- Neighborhoods: Sandy Lane, Holetown, Paynes Bay

- Pros: Luxury appeal, high-net-worth renters, beachfront properties

- ROI Factors: High nightly rates, year-round tourism. Review this useful article on an analysis of the west coast properties prices compared to other parts of the island – Global Property Guide

- South Coast:

- Neighborhoods: Worthing, Rockley, Oistins

- Pros: Popular with tourists and locals, strong Airbnb market

- ROI Factors: High occupancy, moderate property prices

- St. Philip and St. George:

- Pros: More affordable, peaceful neighborhoods

- ROI Factors: Long-term rental demand, room for appreciation

- The Crane and East Coast:

- Pros: New developments and resort-style amenities

- ROI Factors: High-value vacation rentals and resale opportunities

Types of Properties That Perform Well

Some property types consistently perform better than others in Barbados:

- Beachfront Condos: Premium nightly rates and international demand

- Villas with Pools: Popular for families and high-end renters

- Townhouses in Gated Communities: Attract long-term tenants

- Multi-unit Properties: Better cash flow from multiple tenants

- Fixer-Uppers in Up-and-Coming Areas: Lower entry point with appreciation upside

The best investment depends on your goals—cash flow, capital growth, or both.

Tourism and Rental Demand: What Investors Must Know

Barbados has a dual rental market:

- Short-Term/Vacation Rentals:

- Platforms: Airbnb, Vrbo

- Ideal in: West and South Coasts

- Seasonality: High demand during winter, Crop Over, and holiday seasons

- Long-Term Rentals:

- Renters: Expats, professionals, remote workers

- Ideal in: Central and East Coast

- Stability: Steady year-round cash flow

Understanding your tenant profile will help you choose the right type of property and location.

What to Look for in a High-Return Property

Here are the key features to prioritize:

- Proximity to Beaches and Amenities

- Good Internet and Utilities (for remote workers)

- Security (gated community or alarm systems)

- Low Maintenance Features (tiled floors, modern appliances)

- Modern Layout and Furnishings

- Private Outdoor Space (balcony, pool, garden)

Properties that meet these criteria often fetch higher rents and attract repeat bookings.

Financing Options: How Tropical Finance Broker Helps You

At Tropical Finance Broker, we simplify the financing process:

- Access to Local and International Lenders

- Competitive Interest Rates

- Help for Non-Resident Investors

- Pre-Qualification Assistance

- Customized Loan Structuring for Investment Properties

We also walk you through mortgage terms, help you improve your credit profile (if needed), and coordinate with your real estate agent or attorney.

Legal and Tax Considerations for Foreign Buyers

- No Restrictions: Foreigners can own property in Barbados 100% outright

- Stamp Duty & Fees: Usually 1% stamp duty plus legal and registration fees. You can check out more information at the BRA website.

- Property Taxes: Reasonable annual land tax rates

- Rental Income Tax: Applicable for income earned, with allowable deductions

Always work with a local attorney to ensure full compliance.

Your success depends on your team:

- Mortgage Broker: Tropical Finance Broker (that’s us!)

- Realtor: Choose one with experience in investment properties

- Attorney: For legal compliance

- Property Manager: Especially important for overseas owners

- Contractors: For renovations or upgrades

We can easily connect you with your desired team to accomplish your objectives.

How Tropical Finance Broker Supports Your Investment Journey

We go beyond financing:

- Investment Property Consultations

- ROI Calculations and Projections

- Pre-Approval Letters to Strengthen Offers

- Refinancing Options as Value Increases

- Referrals to Trusted Realtors and Attorneys

With our help, you get expert guidance every step of the way—from dreaming to owning. We are more than just a mortgage broker we become part of your team to ensure that you are making the right decisions on the island.

Common Pitfalls to Avoid When Buying Property

- Underestimating Renovation Costs

- Choosing the Wrong Location

- Skipping Professional Inspections

- Not Budgeting for Insurance or Maintenance

- Relying on One Rental Season

- Failing to register your funds with Central Bank

- Managing the foreign currency rental income in a smart way

Tropical Finance Broker helps you avoid these mistakes with a full risk analysis before you buy. We meet with you to truly understand your goals and then hold your hand through the entire process.

Frequently Asked Questions from Property Investors

Q: Can non-residents buy real estate in Barbados?

A: Yes. There are no restrictions on foreign ownership. It is important to note however that you need to manage the process well to ensure that you get maximum returns.

Q: What kind of returns can I expect?

A: Rental yields between 6% to 10% are common in high-demand areas.

Q: Do I need to be in Barbados to complete the purchase?

A: No. You can work remotely with your legal and real estate team. With us locally here in Barbados we can represent you and ensure that we keep the process moving even if you are not here on the island.

Q: How do I finance a property as a non-resident?

A: We connect you with lenders who offer mortgages to foreign buyers. Working with an independent broker like us ensures that we do the heavy lifting and provide you with the best options. If you just work with one bank representative, then you do not truly appreciate all the offers on the island.

Conclusion: Secure Your High-Return Investment in Barbados

The Barbados real estate market is thriving, and the time to invest is now. With the right location, property type, and expert guidance from Tropical Finance Broker, you can secure a high-return investment that pays off for years to come.

Whether you’re looking for vacation rental income, long-term tenants, or capital appreciation, we help you every step of the way—from pre-qualification to close.

At Tropical Finance Broker, we work for you—not just one bank. Unlike traditional loan officers limited to a single institution’s offerings, we compare multiple lenders to secure the best possible rates, terms, and approval conditions tailored to your investment goals. We can save you alot of time!

Whether you’re local or abroad, our team simplifies the financing process, connects you with trusted real estate partners, and helps you maximize your return—all at no upfront cost to you.

👉 Contact us today at support@tropicalfinancebroker.com to schedule your free investment consultation.

Discover the smarter, faster, and more profitable way to invest in Barbados real estate.